The challenges presented by invoice processing can weigh heavily on finance teams. Monthly deadlines that rely on accurate data can be difficult with manual, slow processes. Added to this, pressure from management for reports and cash flow updates means real time data is vital.

Read more about Automated Invoice Processing in our Ultimate Guide.

In this article our aim is to help organisations understand how an automated invoice system can ease pressure and provide a wealth of benefits including early payment discounts, streamlined systems, lowered overheads and reduced stress on staff.

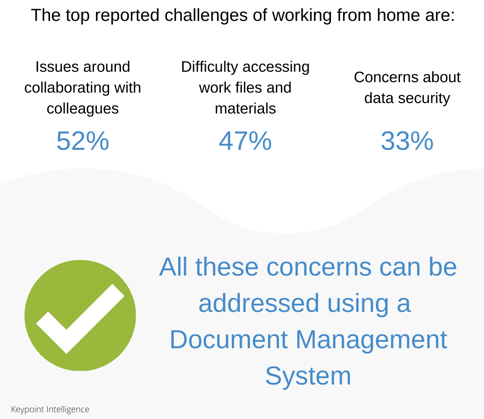

With more and more organisation's moving to a more flexible way of working, enabling employees to work from home means your business processes have to adapt.

Invoices being passed amongst departments, stored in network drives or where the full process is carried out by multiple people may all be unachievable when working remotely.

How DocTech can help:

With automated invoice processing, invoices are stored digitally and accessed by authorised users from any device anywhere with an internet connection.

Working in the Cloud means problems with internal networks or VPN issues are eliminated. Manual invoice processes that were carried out in the office can be replicated digitally.

Inaccurate data, missing invoices, staff absences and information trapped on paper all cause bottlenecks for finance teams and slow the Accounts Payable process down. Longer processing times can mean late payments, fees and overworked staff.

Matching a PO, to an invoice and then to a delivery note can take a long time if data has been added incorrectly or is missing entirely.

How DocTech can help:

AP automation means an invoice, PO and delivery note information is digitally and accurately captured into a document management solution designed for invoice processing.

The system can then match these documents to one another and if a match occurs, the invoice can be set for automatic payment. If there’s no match, it’s flagged to the appropriate user to investigate further.

Missing invoices as well as the time spent looking for them are two of the biggest challenges in invoice processing. Invoices moving around the business in paper form or via email can easily be lost or forgotten about.

Lost invoices cause problems with suppliers, accounting problems and can lead to an inaccurate view about the company’s financial position.

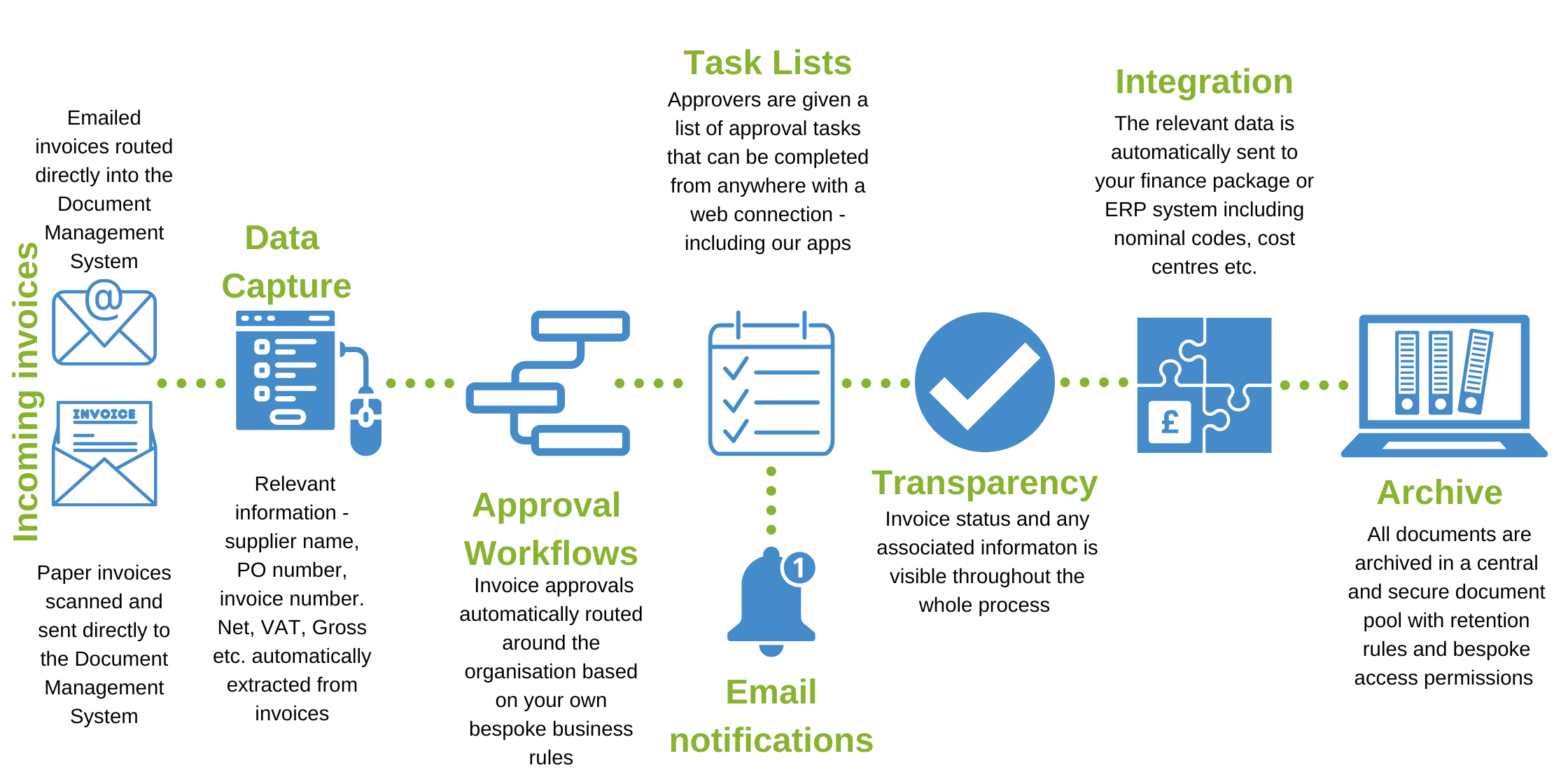

This infographic shows the journey of a digital invoice. Processing invoices this way means they cannot be lost once they enter the system.

How DocTech can help:

Our solutions accurately store and index your organisation's most important information. Data is instantly available from one central source, reducing wasted search times. One member of staff spending an hour a day searching through network folders, papers on desks, emails or filing cabinets for the right information is almost a day of time every week.

That’s almost the equivalent of a full day’s wage – where else could that time and money be spent?

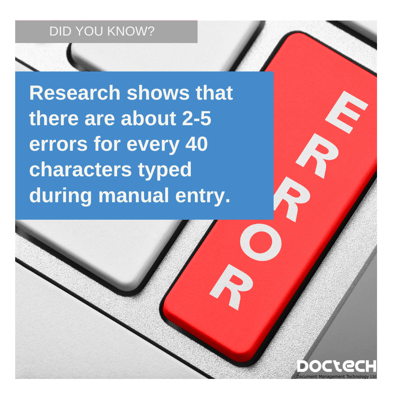

Manual data entry presents a big challenge when processing invoices. Even the most conscientious of employees can make a mistake or run out of time to accurately transfer figures from an invoice into a finance system.

How DocTech can help:

Automated invoice processing removes the need for manual data entry as invoice data is accurately captured into the solution and then pushed in a finance package or ERP system.

This leaves staff more time to do final checks, as well as other more productive work. The data that’s captured is then indexed and stored making it easy to find when needed.

Three way matching is a way of verifying a payment to ensure that a supplier invoice is valid. When an invoice is received it needs to match a purchase order that should have already been received by the purchasing department, as well as a delivery note, to make sure the goods have arrived.

This process is labour intensive as it can be difficult to locate the information required, resulting in late payments and endless searches for finance team members.

How DocTech can help:

When this is automated by invoice processing software, these three documents will already be present, so as long as each has a matching PO number and the invoice amount is less or equal to the PO amount, it can automatically be authorised for payment with no manual intervention.

A task is created for the designated person or team to look at any exceptions which are then managed separately.

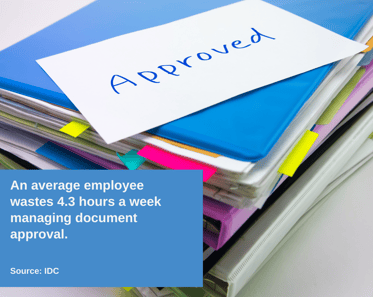

Invoice reviewing and document approval needs to happen before an invoice is paid, and is carried out by designated employees within a business. Manual invoice payment checks can include checking the invoice for accuracy, cross referencing dates, confirming the service or goods with the requestor, checking supplier details and recording the invoice due date. All time consuming, error prone, and pretty laborious.

How DocTech can help:

Now think about a fully automated solution where you can easily route invoice approval requests based on amounts, supplier name or split code billing with multi-levels.

Electronic workflows give organisations the flexibility to keep work moving forward even when someone is away from the office, moving the approval to the next person in line when no action is taken after a set period. Invoices can also be approved by staff when they’re out of the office on a mobile device.

If an organisation has no clear purchase to pay process in place, unauthorised purchases can easily slip through the net. Without the need for a purchase order (PO) to be raised and authorised by an appropriate person, can anyone in your business make an order without checks?

Whether it’s a mistake or a malicious act, once the order arrives it need to be paid. This leaves businesses out of pocket and in a position where protocols need to be quickly put in place.

How DocTech can help:

With a well-defined and automated invoice processing procedure, this scenario can’t happen. A PO is firstly created in the system by only those that have permission to, and digitally sent to managers for authorisation.

It is subsequently sent to finance and any other department depending on what’s being ordered so no-one is left out of the process. Once approved, it’s sent from the buyer to a supplier to request the order.

With this type of purchase order process, a physical or digital document isn’t needed until the process is complete, saving resources.

Managers face challenges with invoice processing when data is trapped on paper or in emails as they can never be 100% sure where payments and approvals are up to. Speaking with staff to find the answers or searching through folders can cause delays and increase processing times.

How DocTech can help:

Invoice processing software provides the visibility and control needed, as each stage of the payment cycle is captured in real time. Billing discrepancies and payment terms can be closely monitored, and accurate reports and performance metrics can be produced.

.png?width=400&height=400&name=document%20security%20(1).png)

Financial information requires organised and secure storage to prevent vital information being lost or stolen. Fraud remains a huge problem for businesses which has been made worse by the Covid Pandemic.

A survey from major accountancy firm BDO found that six in ten, mid-sized businesses in the UK were hit by fraud in 2020, with an average loss totaling £245,000.

How DocTech can help:

With DocuWare, all invoices are stored with AES encryption and data traffic takes place via HTTPS with TLS encryption. This prevents critical data such as passwords and financial information from being captured.

All invoices entering the system are checked against existing suppliers and if there’s no match, they are flagged to be checked.

Access to invoices can also be tightly controlled so you can manage which employees can read, edit, export or delete data.

Being well prepared for a financial audit is key, and while it can seem daunting to have an auditor expose possible errors, the exercise can prove to be hugely beneficial.

A company’s financial statements, documents, data, reporting systems, cash flow statements, tax returns and balance sheets will all be reviewed.

How DocTech can help:

Having a great invoice processing procedure in place will help as an auditor will be able to see the clearly defined steps of how your process works.

On top of this, having easy digital access to all the supporting documentation will greatly reduce audit preparation time. If required, auditors can be granted read only access to DocuWare so they can easily pick any document they need to view.

As business grows, can your processes grow too or will they buckle under the pressure? An increase in customers and suppliers means more invoices to manage and more staff needed to cope, especially if you reply on manual and paper based processes.

Hiring and training staff are time consuming tasks to carry out each time the volume of invoices increase.

How DocTech can help:

Invoice processing software eliminates manual and repetitive tasks that make it difficult scale up. Automation helps you grow your business while maintaining costs.

At DocTech we understand the many challenges of invoice processing. We have the experience and it’s likely we’ve worked through your challenges with our existing clients.

Organisations need to think about what issues are causing the biggest problems to the bottom line and effecting their employees the most? Buy in from staff when implementing invoice processing software is so important, no-one likes change, but demonstrating the positive impact of this change is key, prior to installation.

Invoice automation resolves the challenges we have outlined in this article as well as many others. It’s unlikely there’s a problem you’re having that we haven’t encountered in the past and we’re waiting to hear from you to explain how we can help.

Book a discovery call with our team. They will talk you through our solutions, understand your requirements and can provide a demo if needed.

As organisations are now predominately conducting business online, manual and paper finance processes will struggle to keep up. Traditional ways of working no longer fit into fast paced, modern workplaces and organisations ...

You may have a lot of questions when looking into DocuWare for invoice processing. Here we aim to help readers understand how the digitisation process works and how exactly your accounts payable systems can be automated. You ...

The challenges around document security, audits, approvals and data extraction to name a few, can all be simplified with accounts payable invoice processing software.